INDUSTRY

TECH STACK

ROLES

COLLABORATORS

DELIVERABLES

TIMELINE & STATUS

My responsiblity was to thorougly decipher and understand the company's business model and functioning. This inovlved analyzing the foundational origin jounrey, their strategies, vision, USP, investor's sentiments, competition, unfare advantages, daughter companies, market demographics, current affairs, UI/UX analysis of present product, stock analysis, balance sheet checks, and drawbacks.

For understanding the strategic underpinnings of a high-potential startup in the insurance sector. It provides a comprehensive analysis of the company's business model, market positioning, and operational challenges, about how it almost monoplized the market.

A lot of documentation, literatutre, podcasts, and news studies, etc was involved to reach the outcomes of this case study. Qualitative research was done to understand the drawbacks and gaps in the current functioning of the company. Web-scraping was done to gather data on the company's retention metrics. Finallly the UI/UX analsyis was done by thoroughly using the product and understanding the user journey, pain points, and areas of improvement.

BASIS OF ANALYSIS

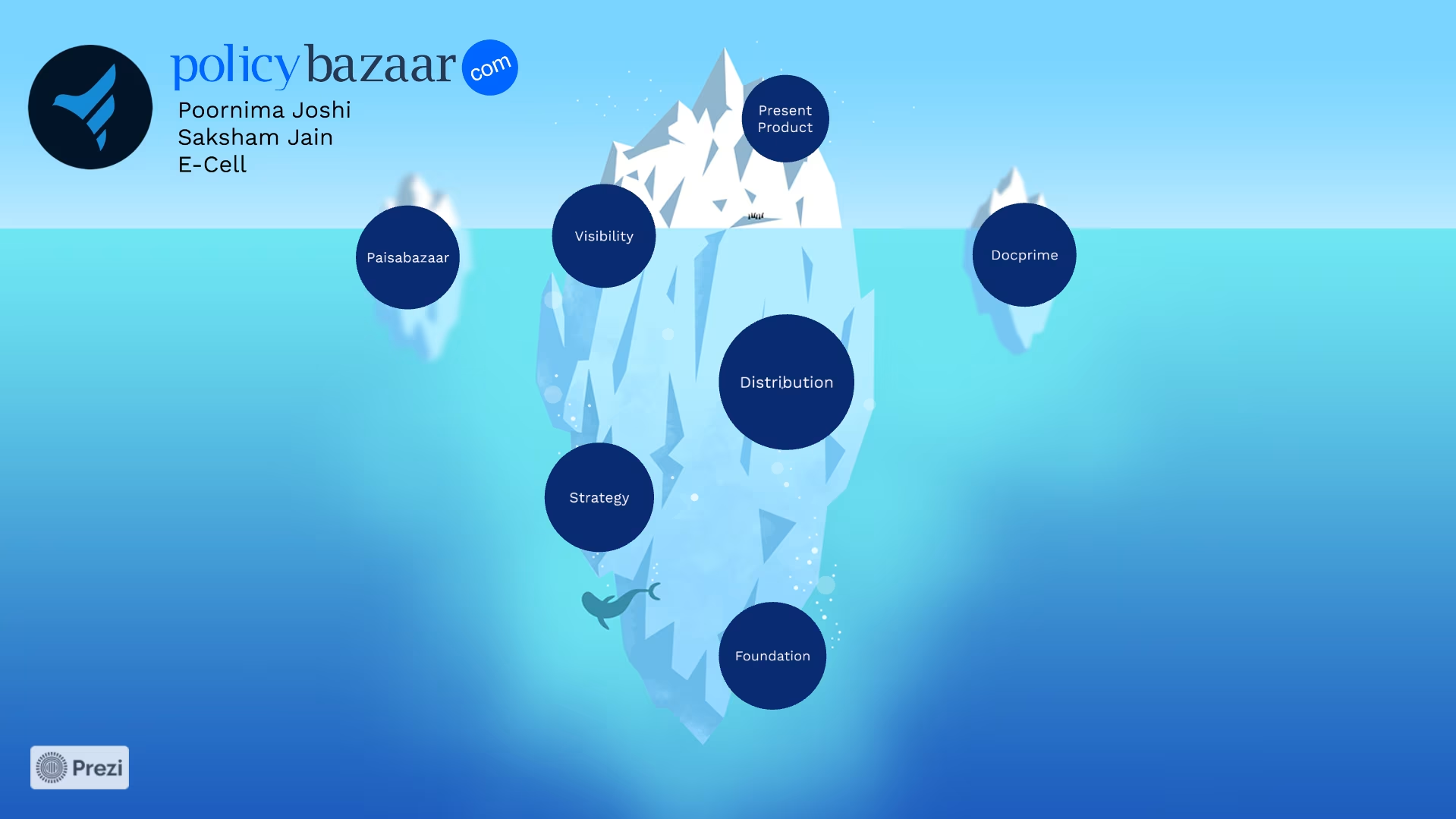

This iceberg isn't just a visual, it's a layered metaphor for PB Fintech's industry presence. At first glance, it may seem like a FinTech company, but beneath the surface lies the emerging InsureTech sector. The submerged base represents PB Fintech's foundation, strategies and distribution networks that are largely invisible to the public eye. As we ascend,we start to see the iceberg under the sky in the form of company's visibility and the role of Paisabazaar and Docprime, two flanking seperate pillars that supports and protects the main iceberg that is PB Fintech, mostly comprising of Policybazaar. The tip of the iceberg is what the common man sees: their visible, accessible products.

FOUNDATION

COMPANY'S TIMELINE

CLICK TO SEE ON EXCALIDRAW

I highly recommend viewing this timeline live on Excalidraw.

It presents a comprehensive and meticulously detailed account of Policybazaar's journey, capturing all major milestones, structural changes, and pivotal moments in the company's evolution. The timeline also illustrates when and how key investors entered the picture, highlighting their contributions in terms of timing, strategic influence, and capital investment.

STRATEGY

To understand what was happening with Policybazaar during this period, think of it like Steam—the popular video game distribution platform. Steam didn't create or own the games it sold; it simply built a robust marketplace for game developers to list and distribute their titles. Similarly, Policybazaar wasn't creating insurance policies, but was building a powerful digital platform where various insurers could list and sell their offerings. This phase of the timeline marks the addition of major policy providers, solidifying Policybazaar's role as the go-to distribution hub for insurance in India.

You might be wondering why I've highlighted mutual funds in the strategy slide?

The reason is quite fascinating and underscores Policybazaar's clever market positioning and controlled brand visibility. Mutual funds in India are often associated with risk, amplified by regulatory disclaimers in advertisements that emphasize volatility. Naturally, this could conflict with the trust-driven, transparent image Policybazaar has cultivated as a neutral policy marketplace.

So, did Policybazaar completely sidestep this space to protect its brand perception? Not quite. Instead, they adopted a low-visibility strategy. Mutual funds are not even mentioned on the homepage, and there's little to no aggressive marketing around them. However, with a simple search, users can land on Policybazaar's mutual funds page (https://www.policybazaar.com/funds/) a product offering quietly tucked into their ecosystem.

This intentional concealment aligns with how the mutual fund audience behaves: those interested are typically informed and research-driven. Policybazaar leverages this by maintaining trust with the general public while still tapping into the mutual funds segment in a subtle, brand-safe way.

FINANCIALS & INVESTORS

At first glance, this financial chart may suggest that Policybazaar is incurring losses, as its expenses appear to exceed revenue. However, it's important to note that this data represents Policybazaar alone, not the entire parent company, PB Fintech Ltd. A deeper look into the stock analysis of PB Fintech reveals the full picture, uncovering the actual business model and strategic play behind Policybazaar's operations.

I make it a habit to carefully analyze the balance sheet of a company to assess its actual financial health and more importantly, to ensure that its total equity and liabilities match total assets, as this reflects proper accounting and financial structure.

Total Assets Growth

FY 2021: ₹34,312.04 lakhs → FY 2022: ₹55,055.39 lakhs

(+60.45%)Equity Expansion

Total Equity grew from ₹7,941.29L to ₹18,227.73L

(+129.5%)- Share Capital: ₹6,610.74L → ₹7,484.82L

- Reserves & Surplus: ₹1,330.55L → ₹10,742.91L

Non-Current Assets

₹12,113.82L → ₹17,526.59L

(+44.7%)- Right-of-use assets grew significantly (₹7,785.63L → ₹10,340.07L)

- Deferred Tax Assets nearly doubled: ₹1,726.56L → ₹3,355.72L

Current Assets Surge

₹22,198.22L → ₹37,528.80L

(+69%)- Investments: ₹6,955.02L → ₹10,139.44L

- Receivables: ₹10,759.89L → ₹15,294.32L

- Cash: ₹3,223.27L → ₹5,316.48L

Liabilities Breakdown

Non-Current: ₹9,542.54L → ₹12,137.42L (+27%)

Current: ₹16,828.21L → ₹24,690.24L (+46.7%)

- Trade Payables rose by ₹3,444.68L

- Other Financial Liabilities jumped by ₹2,268.84L

Summary Table

| Indicator | FY 2021 | FY 2022 | Change |

|---|---|---|---|

| Total Assets | ₹34,312.04L | ₹55,055.39L | +60.45% |

| Total Equity | ₹7,941.29L | ₹18,227.73L | +129.5% |

| Reserves & Surplus | ₹1,330.55L | ₹10,742.91L | +707.2% |

| Trade Receivables | ₹10,759.89L | ₹15,294.32L | +42.1% |

| Cash & Equivalents | ₹3,223.27L | ₹5,316.48L | +64.9% |

Final Insight

- Strong equity and reserves growth reflect healthy investor confidence.

- Asset growth outpaces liabilities, indicating sound financial management.

- Substantial liquidity and operational scale-up visible via receivables and cash jumps.

You'll be able to find the strategic entry of key investors like Info Edge, Tiger Global, Tencent, and others within the company's timeline section, each bringing not just capital, but market influence and domain expertise at critical phases of Policybazaar's growth.

VISION & USP

Policybazaar's core vision is to democratize insurance by creating a transparent, digital-first platform that empowers consumers to make informed decisions without relying on agents. Their strategy revolves around leveraging technology to simplify and scale the insurance buying experience.

Vision: Customer-first Transparency

Policybazaar launched with the intent to eliminate the information asymmetry in India's insurance space. By offering side-by-side policy comparisons and transparent terms, it shifted power from agents to consumers.

USP: Aggregator + Assistant + Automation

- Licensed by IRDAI as a legitimate insurance aggregator.

- Zero service fee model builds trust and eliminates agent commissions.

- Supports complete lifecycle: comparison, purchase, renewals, and claims.

- Integrated call center and bot-assisted services for smoother user experience.

AI & Voice Analytics

Leveraging NLP on 35M+ minutes of call recordings monthly to extract deep user insights (e.g., income, family size, preferences). This fuels personalization and product tailoring at scale.

PBee Connect Bot

- AI chatbot for car insurance sales and lead routing.

- Handles 80% of queries autonomously, boosting agent productivity from 1.5 to 7–8 policies/day.

- Enabled a 4x scale in motor insurance operations.

AWS + Polly + SageMaker Stack

- Amazon Polly enables multilingual TTS responses, enhancing user engagement in Tier 2/3 regions.

- SageMaker powers real-time ML for leads, preferences, and voice-to-text conversion.

- AWS cloud infra cut costs by 25%, while scaling up call center infra efficiently.

Business Model Shift

- Started with insurance comparison; moved to full-stack policy sales and claim support.

- Call center monetization by servicing insurers directly.

- Revenue streams: lead gen, ad placements, commissions, loans & credit card partnerships.

Impact Metrics

- 10M+ policies sold by 2019, a year ahead of target.

- 300K monthly voice interactions via Polly + PBee Connect.

- 63% positive response rate and 41% policy closures via bot without human intervention.

Strategic Summary

- Technology-driven transformation from comparison platform to full-service insurance ecosystem.

- AI and automation enabled 4x operational scaling while maintaining service quality.

- Multi-revenue model diversification beyond traditional commission structures.

- Strong focus on regional expansion through multilingual capabilities and voice technology.

Policybazaar's tech-led vision positioned it as India's most trusted InsurTech brand. Automation, AI, and voice tech removed dependency on agents and offline ops. Model replicable in other sectors like online food delivery, e-retail, and financial advisory.

COMPETITOR ANALYSIS

Policybazaar here captures 65% digital sales share with 250K+ agents (25% life, 7% health; 1.2% total GWP share, ₹11,590 cr GWP; ₹400 cr revenue).

SUBSIDARIES

Paisabazaar is expanding from personal loans to home and property loans, now making up over 30% of its disbursals, supported by an offline agent network. It partners with banks to launch exclusive offerings like StepUP and Duet cards, generating long-term revenue through customer usage. Over 50 million users have accessed free credit scores via Paisabazaar, making it a leading platform for financial literacy and access.

MARKET

PRESENT PRODUCT

CURRENT AFFIARS

CURRENT DRAWBACKS